irs unemployment tax refund status 2021

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

It all started with passage of the American Rescue Plan Act of 2021 also called ARP that excluded up to 10200 in 2020 unemployment compensation from taxable income.

. Our filing season preparation began early last year and included extensive planning and. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. To report unemployment compensation on your 2021 tax return.

The law reduces the tax burden for unemployment recipients by up to 10200 but because it wasnt passed until March 11 many unemployment recipients who filed early paid too much. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Another way is to check your tax transcript if you have an online account with the IRS.

An eleven percent increase in return tax returns filed in 2021 has left millions waiting for their refund from the IRS. The IRS e-File open date is Jan. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

The IRS had. The IRS has already sent out 87 million. Irs unemployment tax refund august update.

Under the American Rescue Plan Act of 2021 Americans who received unemployment compensation in 2020 received relief. The most recent batch of unemployment refunds went out in late july 2021. Check For the Latest Updates and Resources Throughout The Tax Season.

Prepare federal and state income taxes online. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR.

Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. By Anuradha Garg. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to.

Login to keep track of your entries. The American Rescue Plan Act of 2021 was signed in March and temporarily revised the rules for taxation of unemployment benefits. For married individuals filing a joint tax return this.

Answer 1 of 7. Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

More unemployment tax refunds coming irs says. The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. Had a California Adjusted Gross Income CA AGI of to 000 for the 2020 tax year.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations. IR-2021-159 July 28 2021. The Department of Labor has not designated their state as a credit.

The IRS will determine the correct taxable amount of unemployment compensation and. It allows eligible taxpayers to report up to 10200 of their. The Internal Revenue Service IRS sends a 5071C letter to the Jul 13 2021 Millions of tax refunds delayed 0711.

8 million people who paid taxes Jan 10 2022 2022 Tax Refund Schedule 2021 Tax Year Note. The IRS started accepting 2021 tax returns on Jan. However the irs has not yet announced a date for august payments.

Some 2020 unemployment tax refunds delayed until 2022 irs. Around 540000 minnesotans can expect to get a tax refund with the first 1000 payments going out this week. Hey all I got a tax refund back on July 13th for about 1073 since I filed my taxes before the 10200 unemployment bill passed.

I got a notice on July 26 from the IRS saying Ill be getting a refund of 1066 within the next 2-3 weeks. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF.

As far as I know the ACH IRS Treas 310 is a refund for the direct deposit just like. In the latest batch of refunds announced in november however the average was 1189. 2 days agoFees vary depending on the place and they only accept cash up to 00.

Tax refund recession unemployment rate Do. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. 22 2022 Published 742 am.

For individuals it excludes up to 10200 of their unemployment compensation from their gross income if their modified adjusted gross income is less than 150000. Another 15 million taxpayers are now slated to get refunds averaging over 1600 as part of the IRS adjustment process in the wake of recent legislation. 2021 tax preparation software.

An estimated 13 million taxpayers are due unemployment compensation tax refunds. Thats the same data. IR-2021-212 November 1 2021.

You may check the status of your refund using self-service. Efile your tax return directly to the IRS. 2 days agoI do not have a VPN but have tried several times in the past week to access IRS refund status site without success.

They fully paid and paid their state unemployment taxes on time. 100 Free Tax Filing. Those refunds are supposed to keep coming through the end of summer.

Already filed a tax return and did not claim the unemployment exclusion.

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Income Tax Federal Income Tax Irs Taxes

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

430 000 Americans To Receive Stimulus Check Totaling To Over 510 Million The Republic Monitor

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Sending Out 4 Million Surprise Tax Refunds This Week Wpri Com

Tax Refund Timeline Here S When To Expect Yours

Tax Return Status Why Is My Federal Refund Delayed 10tv Com

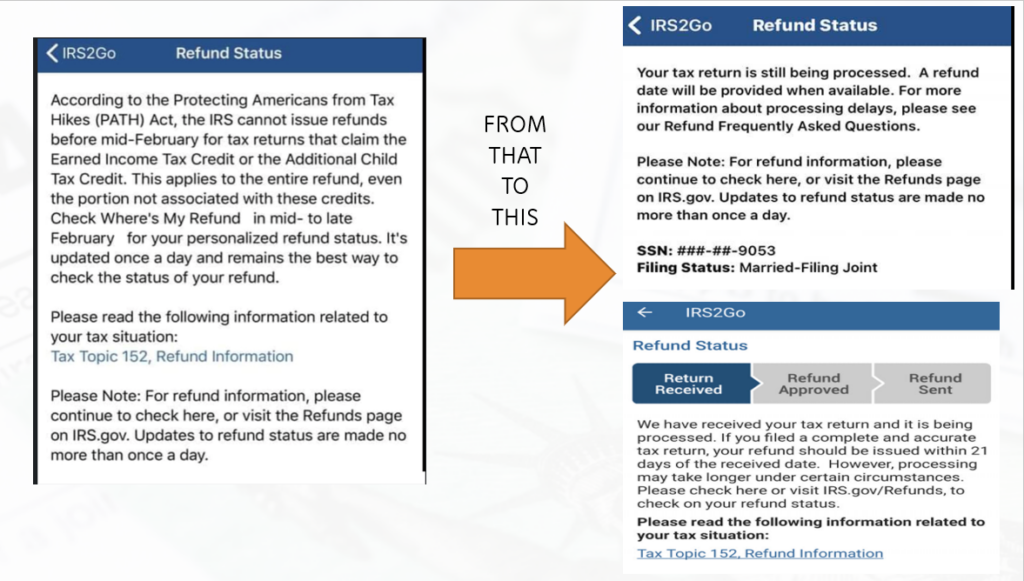

Tax Refund Status Is Still Being Processed

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

When Will I Get My Irs Tax Refund Latest Payment Updates And 2022 Tax Season Statistics Aving To Invest

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor